|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

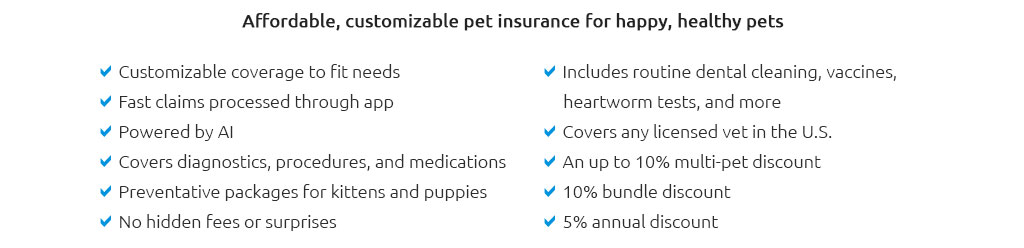

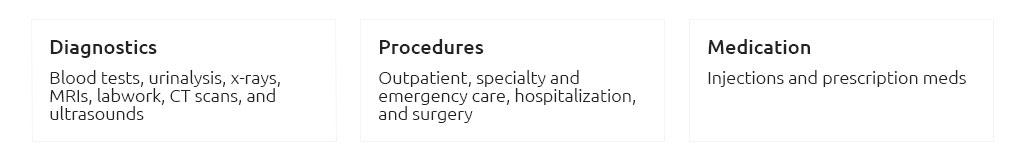

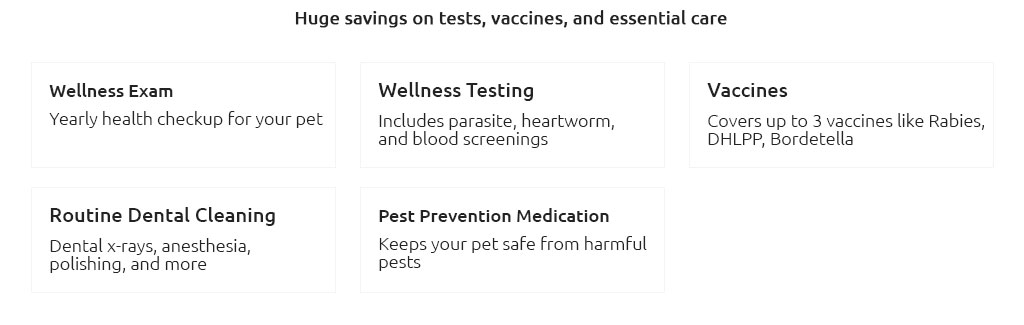

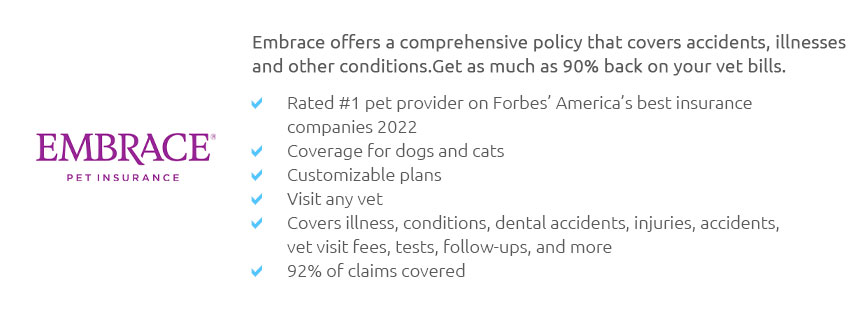

How to Choose Pet InsuranceChoosing the right pet insurance for your beloved furry friend is a task that requires careful consideration and a bit of introspection. Just as with human health insurance, pet insurance can be a crucial investment in your pet’s long-term health and well-being. To navigate this often complex landscape, it is essential to take into account various factors, which will ensure that you make an informed and beneficial decision. First and foremost, consider the coverage options. Policies vary significantly, ranging from accident-only coverage to comprehensive plans that include routine care. Accident-only plans might seem attractive due to their lower cost, but they won’t cover illnesses, which can be a critical component of a pet’s health care. Comprehensive plans, on the other hand, offer extensive coverage but come at a higher premium. It’s important to assess your pet’s health history and lifestyle when deciding which type of coverage is most suitable. Another pivotal aspect is the cost. While it might be tempting to go for the cheapest option available, remember that low premiums often come with higher deductibles or limited coverage. It is advisable to look at the big picture by considering not only the monthly premium but also the deductible, reimbursement rate, and annual limit. A balanced approach that fits your budget while offering adequate protection is often the best strategy. The insurer’s reputation and reliability cannot be overlooked. Researching the company’s history, reading reviews, and understanding their claim process can provide valuable insights. An insurer with a reputation for excellent customer service and a straightforward claims process can save you a lot of headaches in the future. Ask for recommendations from friends, family, or your veterinarian to get a sense of which companies are trustworthy. Exclusions and limitations are other key elements to consider. Many insurance policies have specific exclusions for pre-existing conditions, hereditary issues, or certain breeds. Carefully read the policy’s fine print to understand what is not covered, as this can significantly impact the policy's effectiveness. Additionally, look into whether the insurer offers any add-ons or riders that can extend the coverage to meet your pet’s specific needs. Furthermore, some policies offer wellness coverage, which includes preventive care such as vaccinations and annual check-ups. While not essential for everyone, if you prefer a plan that covers routine care, be sure to compare the cost of such coverage against paying out-of-pocket.

In conclusion, selecting pet insurance is a decision that should be made with thorough research and thoughtful consideration. By understanding the various aspects of coverage, cost, and the insurer’s reliability, you can choose a policy that not only meets your financial constraints but also provides peace of mind, knowing your pet is protected. Ultimately, the right insurance plan will offer a safety net that enables you to focus on providing love and care for your pet, rather than worrying about unexpected medical expenses. https://www.quora.com/How-do-you-determine-if-getting-pet-insurance-is-a-wise-financial-move

My recommendation is to Review various policies available and determine the monthly premium for your pets. Then carefully read the microscopic ... https://www.dogsforgood.org/good-advice/dog-insurance/

There are four main types of dog insurance generally available and to help you decide we've detailed what each one covers and for how long. https://homebody.com/resources/how-to-choose-pet-insurance

This simple and detailed guide will outline the crucial elements to consider when choosing pet insurance providers.

|